L

LequteMan

Guest

There had been reports that the federal government is considering an increase in VAT (Value Added Tax) of recent. It has been one of government's forefront considerations to increase its revenue stream.

Nigeria, with a VAT rate of 5% is low compared to 19.25% VAT paid in Cameroon, 14% paid in South Africa and 17.5% in Zambia. In Egypt, 10% is charged on standard goods and services while 25% is charged on luxury items and zero on exports. VAT in Kenya ranges between 12-16% while in India, it is between 5.5% and 14.5%.

The unemployment rate in Nigeria is expected to rise to 10.5% by the end of the first quarter of 2016, from 9.9% in Q3'2015 according to the Trading Economics global macro models. Inflation has also been on a steady increase since 2015 currently stands at 9.6%. An increased VAT will consequently increase inflation rate, as businesses will see it as an excuse to raise prices of goods and services arbitrarily.

Also, the GDP annual growth rate at 2.84% in the third quarter of 2015 showed a decline in economic productivity from previous level of 6.23% in the third quarter of 2014, and cannot support a VAT increase. All these macro-economic variables suggest that a VAT increase is not a welcome financial burden that Nigerians will be willing to take on.

With Nigerian being among the most unequal countries in the world in terms of income distribution, an increase will therefore shrink the purchasing power of the already impoverished Nigerian income earner.

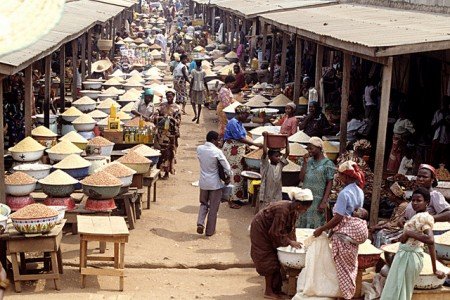

Nigeria has one of the highest poverty rates in the world and an increase in a consumption tax like VAT would be a huge burden on the average Nigerian. Goods and services (including foods and transportation) will be more expensive and the common man will have less money to afford them.

Moreover, a VAT increase would increase the government revenue stream, which can be invested in infrastructure, other developmental projects, and stimulate economic growth. The additional revenue would help reduce government’s dependence on oil revenue. Whilst this is good, the immediate increase could reduce overall consumption and further slow-down the economy making it counter-productive.

Proshare

Nigeria, with a VAT rate of 5% is low compared to 19.25% VAT paid in Cameroon, 14% paid in South Africa and 17.5% in Zambia. In Egypt, 10% is charged on standard goods and services while 25% is charged on luxury items and zero on exports. VAT in Kenya ranges between 12-16% while in India, it is between 5.5% and 14.5%.

The unemployment rate in Nigeria is expected to rise to 10.5% by the end of the first quarter of 2016, from 9.9% in Q3'2015 according to the Trading Economics global macro models. Inflation has also been on a steady increase since 2015 currently stands at 9.6%. An increased VAT will consequently increase inflation rate, as businesses will see it as an excuse to raise prices of goods and services arbitrarily.

Also, the GDP annual growth rate at 2.84% in the third quarter of 2015 showed a decline in economic productivity from previous level of 6.23% in the third quarter of 2014, and cannot support a VAT increase. All these macro-economic variables suggest that a VAT increase is not a welcome financial burden that Nigerians will be willing to take on.

With Nigerian being among the most unequal countries in the world in terms of income distribution, an increase will therefore shrink the purchasing power of the already impoverished Nigerian income earner.

Nigeria has one of the highest poverty rates in the world and an increase in a consumption tax like VAT would be a huge burden on the average Nigerian. Goods and services (including foods and transportation) will be more expensive and the common man will have less money to afford them.

Moreover, a VAT increase would increase the government revenue stream, which can be invested in infrastructure, other developmental projects, and stimulate economic growth. The additional revenue would help reduce government’s dependence on oil revenue. Whilst this is good, the immediate increase could reduce overall consumption and further slow-down the economy making it counter-productive.

Proshare