In response to the recent historic plunge of the national currency, the Nigerian government is reportedly considering a bold policy shift. Strong indications suggest that the Federal Government is contemplating the conversion of foreign currencies in domiciliary accounts, both individual and corporate, to naira. The move aims to stabilize the struggling national currency, which recorded a significant 24% depreciation against the dollar earlier this week, closing at N1,348 per dollar. Top Presidency sources reveal that this initiative is driven by the need to counteract forex scarcity and prevent hoarding of foreign currencies, especially during certain periods of the month.

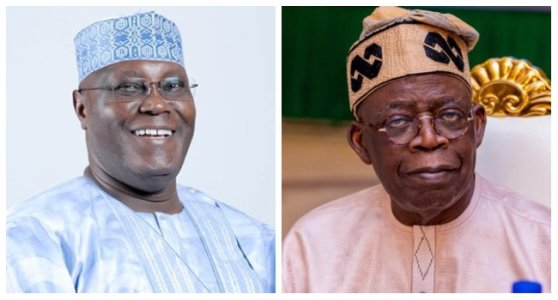

The proposal, if implemented, marks a significant departure from the administration's earlier stance. In September 2023, the President Bola Tinubu-led government expressed intentions to attract funds held in domiciliary accounts and by Nigerians abroad for massive investments in various sectors of the economy. The Minister of Finance, Mr Wale Edun, emphasized the potential of these funds to rejuvenate the economy.

However, the proposed conversion could face resistance, with concerns raised by a branch manager of a Tier-1 bank in Lagos. The manager pointed out potential challenges, including determining the conversion rate and the possibility of the government putting a lien on funds in domiciliary accounts. Meanwhile, the Minister of Finance, CBN Governor, and EFCC Chairman held a meeting in Abuja to discuss strategies for enhancing financial system efficiency and stabilizing the naira.

In a related development, the Central Bank of Nigeria (CBN) has banned banks and fintechs from offering International Money Transfer Services. The new guidelines also include an increase in the minimum share capital requirement for International Money Transfer Operators (IMTOs) to $1 million. The CBN aims to address foreign exchange market challenges and enhance the integrity of financial regulations. Despite these measures, the naira's fall against the dollar has slowed in the past three days, offering a glimmer of hope amid the ongoing economic uncertainties.